US stock markets began the midweek session under pressure, with the S&P 500 dropping more than 1% before recovering and positioning itself slightly higher.

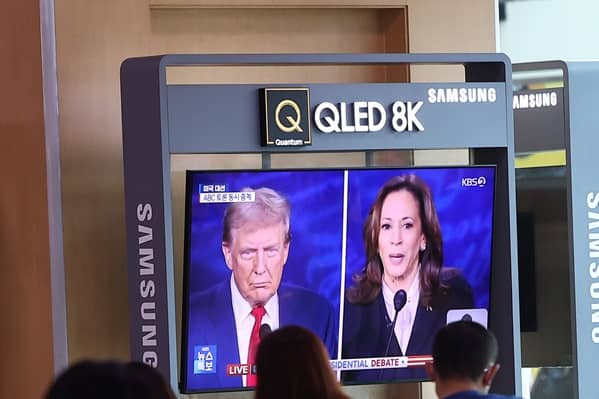

This initial movement was largely due to the development of the presidential debate. In political terms, and broadly speaking, Kamala Harris stood out as the clear winner of the debate.

Her performance showed a presidential approach, based on clear principles and effective communication, which were crucial given the lack of formal exposure the current vice president had previously had.

Harris successfully presented a coherent vision, which has been positively received. In contrast, Donald Trump focused on controversial topics, with comments that diverted attention from the most pressing economic issues, such as the fact that Harris is already in the White House and yet economic problems have persisted. Trump also resorted to direct attacks and questionable claims, such as the suggestion that immigrants were using pets as food, which did not play in his favor.

For the markets, a potential victory for Harris implies a growing risk of higher taxes, a perspective that, in simple terms, is not favorable for large corporations. However, losses in the stock markets have been mitigated, with the S&P 500 managing to reposition itself in positive territory by the end of the session.

A key factor in this positive turnaround has been the August CPI report, which showed a greater-than-expected slowdown in inflation, with an annual rate of 2.5%, the lowest since February 2021. The drop in energy prices, especially gasoline (-10.3%), was the main driver behind this decline. These figures strengthen the expectation that the Federal Reserve will begin to normalise rates at its next meeting, which is generally seen as a positive factor for the equity markets.

Leave a Comment